The art of doing business under GST : Mohit Aggarwal Aastha Group

A large portion of India's business exchanges will soon travel through the innovation drove GST framework. This will change the way firms cooperate with each other and with the Government notify Mohit Aggarwal Aastha Group.

As near one crore firms/people will begin utilizing this framework soon, it is helpful to see how a firm will finish a basic business exchange under GST.

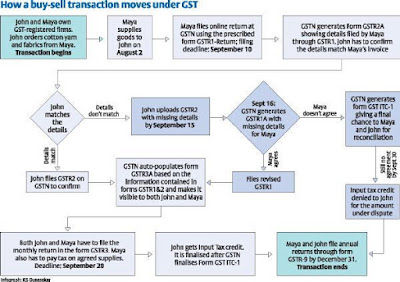

Meet Maya and John. They are proprietors of the two GST-enlisted firms. Maya produces quality cotton yarn and texture and supplies these to piece of clothing creators, for example, John.

A business happens explain by Mohit Aggarwal Aastha Group;

How about we accept GST is set up. John puts in a request on Maya for a few amounts of cotton yarn and texture. Maya supplies it on August 2.

Alongside the merchandise, she additionally sends two duty solicitations, one each for yarn and texture. On this supply, Maya now needs to pay GST utilizing the GSTN (Goods and Service Tax Network). GSTN is basically a solitary window framework for GST.

Maya sign on to GSTN on September 10 and transfers subtle elements of provisions made to John utilizing GSTR1 (GST Returns-1). Each enlisted assessable individual needs to outfit the points of interest of outward supplies in GSTR-1 by the tenth of the resulting month in which the supply happens.

What occurs next is fascinating. GSTN auto populates another frame (GSTR2A) with the data provided by Maya through GSTR1 and makes it noticeable to John.

As near one crore firms/people will begin utilizing this framework soon, it is helpful to see how a firm will finish a basic business exchange under GST.

|

| Mohit Aggarwal Aastha Group |

Meet Maya and John. They are proprietors of the two GST-enlisted firms. Maya produces quality cotton yarn and texture and supplies these to piece of clothing creators, for example, John.

A business happens explain by Mohit Aggarwal Aastha Group;

How about we accept GST is set up. John puts in a request on Maya for a few amounts of cotton yarn and texture. Maya supplies it on August 2.

Alongside the merchandise, she additionally sends two duty solicitations, one each for yarn and texture. On this supply, Maya now needs to pay GST utilizing the GSTN (Goods and Service Tax Network). GSTN is basically a solitary window framework for GST.

Maya sign on to GSTN on September 10 and transfers subtle elements of provisions made to John utilizing GSTR1 (GST Returns-1). Each enlisted assessable individual needs to outfit the points of interest of outward supplies in GSTR-1 by the tenth of the resulting month in which the supply happens.

What occurs next is fascinating. GSTN auto populates another frame (GSTR2A) with the data provided by Maya through GSTR1 and makes it noticeable to John.

Comments

Post a Comment